VAT is an important aspect of selling. For your accounting purposes and to help you comply with the laws in your state or other jurisdiction, GonnaOrder allows you to configure store VAT settings. You can have a store-wide VAT or an item-level VAT setting. VAT information is displayed in all order receipts.

On This Page

Set the Default Store VAT

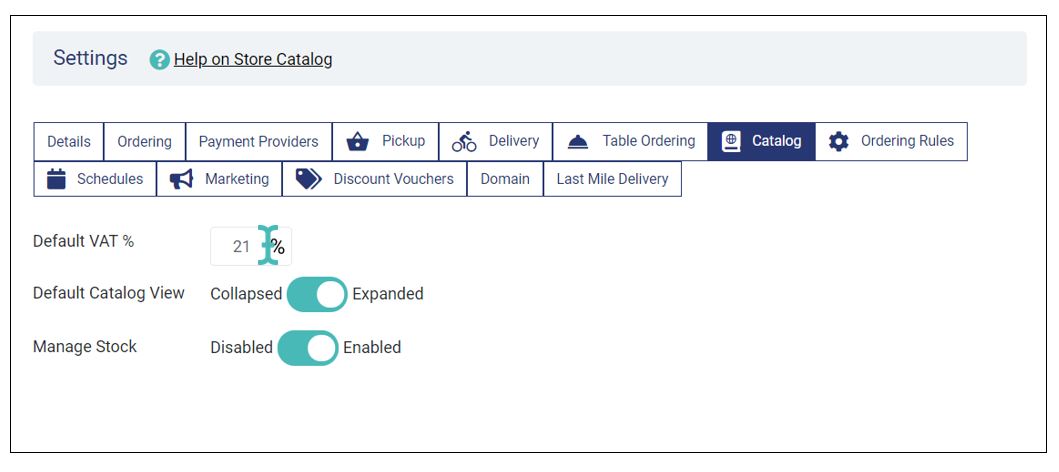

GonnaOrder store managers can set the default store VAT to be applied to the price of all items included in every order. The default VAT is a store-level setting and is applied to individual items added to a cart rather than to the order. The total VAT charged to an order is cumulative of the VAT charged on individual items. Default VAT should be the value approved for a larger percentage of items listed in your store.

To set the value of the default VAT, go to Settings > Catalog. Fill in the VAT field as per the regulations in the jurisdictions in which your store operates.

When set, the order pdf sent to customers will indicate the VAT value and the amount.

Configure Item-Level VAT

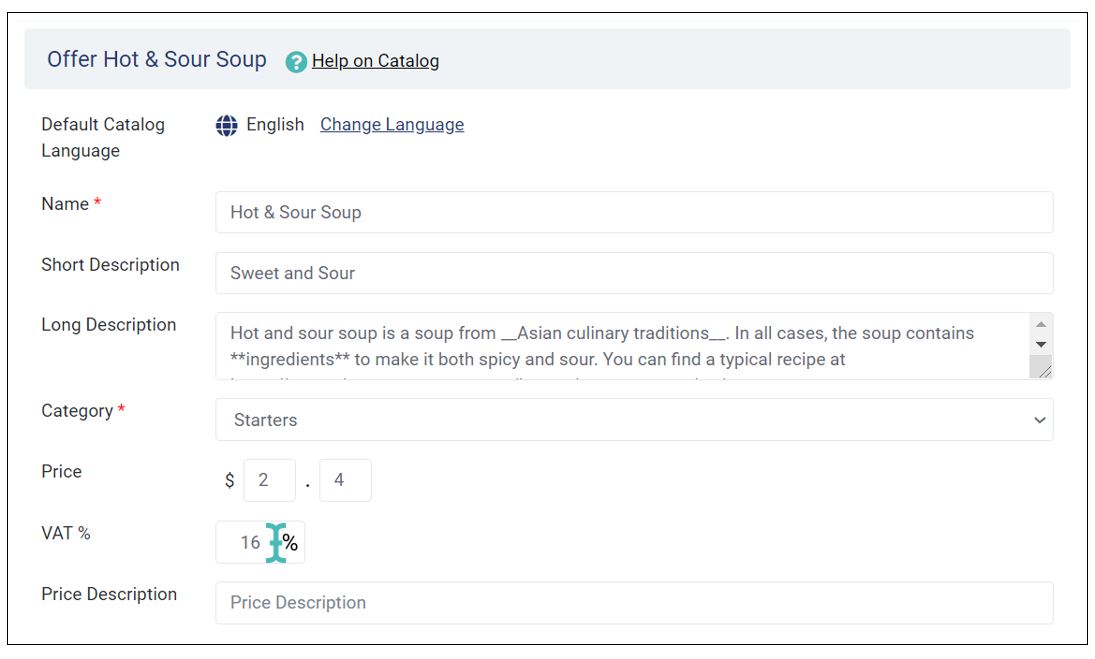

Different products in your store may have unique VAT requirements. This brings the need for item-level VAT settings. With item-level VAT, individual products in your store can have a VAT value, different from the store default.

However, you can only set product level VAT if the default store VAT is greater than zero(0). The item VAT takes precedence when GonnaOrder is calculating the total VAT of an order. Therefore, if a store has 21% default VAT and a certain item has 16% VAT, then the item VAT amount will be 16% of the price and not 21%.

When both default store VAT and item VAT are set, the total VAT on orders will be the sum of the VAT calculated from the two values.

Tip

Both the default and item VAT are calculated using the discounted prices, if any. This is because it is the price that customers pay to the store.

To set an item VAT, go to your catalog and pick the item that has unique VAT requirements. Click on the item to edit and on the product details page, enter the respective VAT percentage and save.

How GonnaOrder Uses Your VAT Information

GonnaOrder uses your VAT information to improve your store. For example, order receipts generated in your store display your invoice number and the VAT amount charged for every purchased item. Additionally, your accounting team can use the VAT values in the order item reports calculating the amount of tax you should pay for a certain duration.

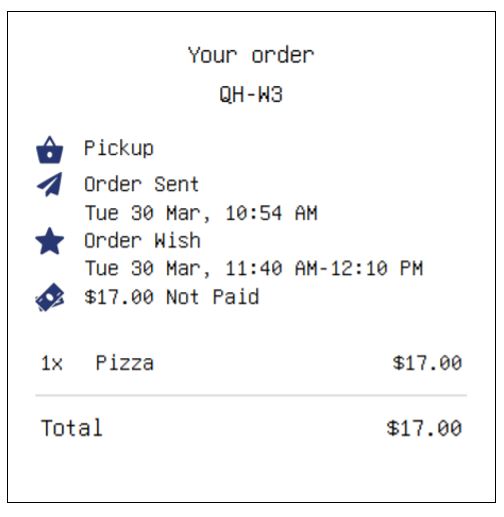

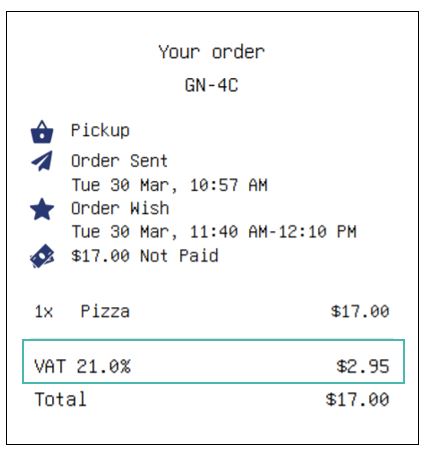

VAT Information in the Order Receipt PDF

Store VAT information will appear in the PDF order receipts sent to your customers via email and which you can download from your store dashboard. Both the default VAT and the product VAT appear after the list of products included in the order.

When the default VAT is 0% or not set, GonnaOrder does not include the percentage discount nor does it include the VAT amount.

Tip

The store VAT number is displayed on the order receipt header so that receipts can be used for legal purposes. Additionally, your VAT number is added to your GonnaOrder subscription invoice. See how to manage your billing information, including your VAT number.

VAT Information in Downloaded Item Reports (Statistics)

You can download your order item reports through the statistics section of your store dashboard.

The itemized order items report shows the details of every item sold by your store during a certain period. The details of this report include the VAT charged on each item. With this information, your accountant can easily compute the VAT amount to be paid by the store.